Department of Economics, Faculty of Social Science, University of Macau successfully held the Greater Bay Area Market Design Workshop 2025 several weeks ago. Fourteen top scholars in the field of market design from the United States, Japan, the United Kingdom, Germany, Canada, Singapore, Brazil, as well as the China mainland and Macau, jointly discussed how to use frontier mechanism design theory to solve the problems of resource allocation efficiency and fairness in key fields such as education, medical care, public recruitment, housing and organ donation, and shared a series of innovative research with both theoretical breakthrough and practical value.

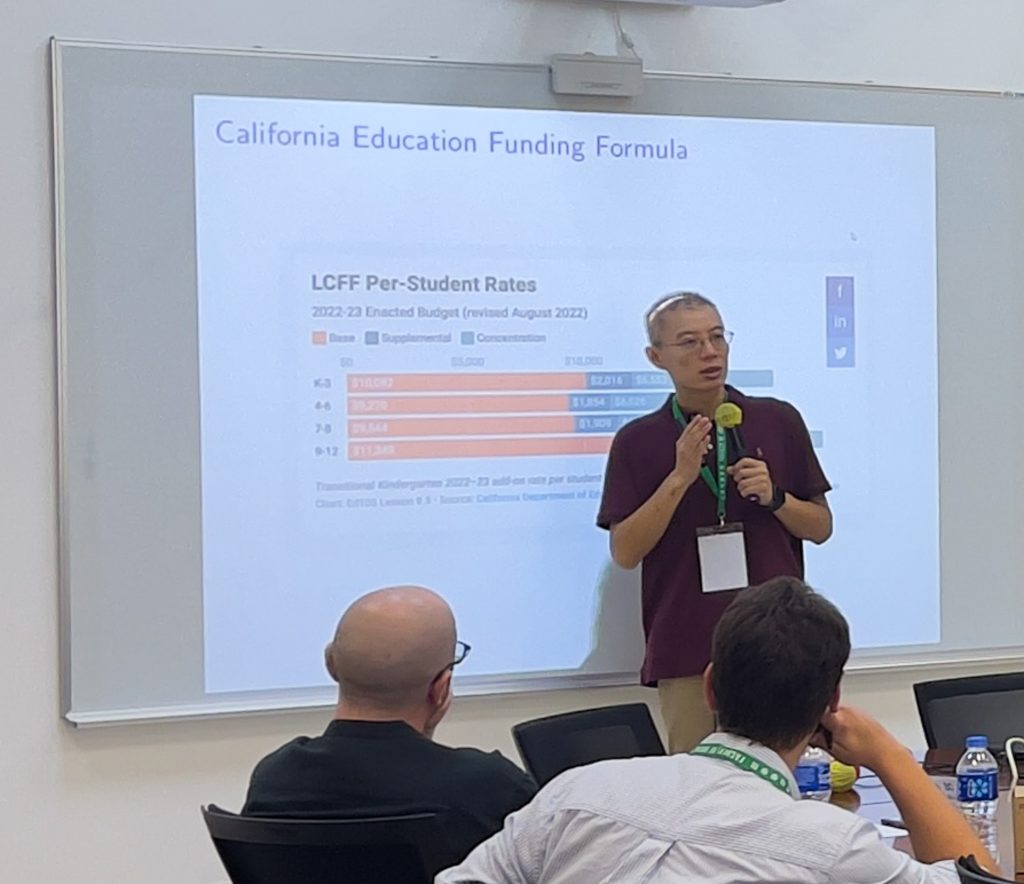

1. School Finance, Peers and Choice

Yu Zhou(Nagoya University, Japan)

Prof. Yu Zhou focuses on a special case of school choice. He proposed a model of school choice with funding, in which school resources depend not only on facilities and teachers but also on student composition. His research provides theoretical support for policies like supplemental grants for high-need students and introduces matching algorithms that ensure both fairness and efficiency.

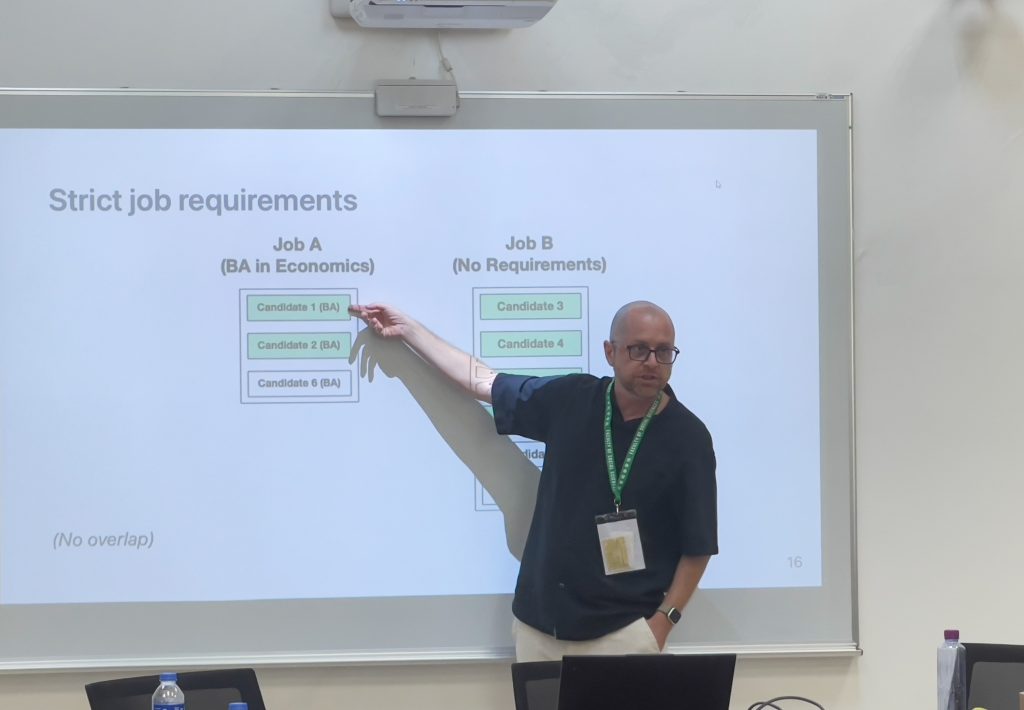

2. Diversity in Choice as Majorization

Bumin Yenmez(Washington University in St. Louis, USA)

Prof. Bumin Yenmez focuses on school admission. He developed a new rule to measure diversity in school admissions, proposing enrollment rules that are more flexible and mathematically robust than traditional quota systems, helping to achieve diversity.

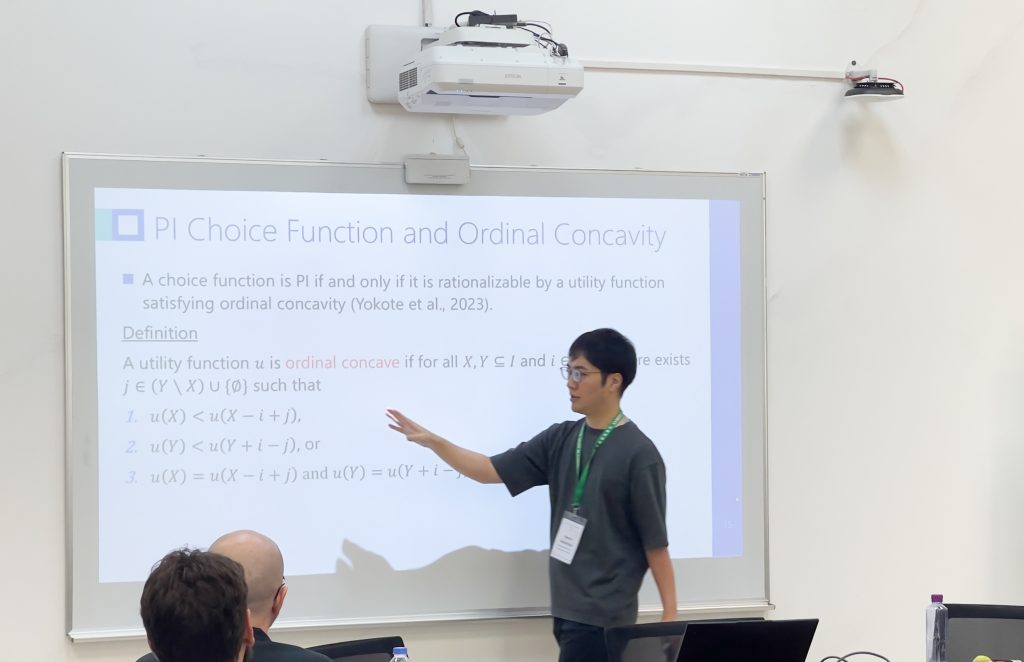

3. Properties of Path-Independent Choice Correspondences and Their Applications to Efficient and Stable Matchings

Kenzo Imamura(University of Tokyo, Japan)

Prof. Kenzo Imamura studies a special case of matching problems. He finds that realistic decision-makers face multiple equally preferable options, and they select multiple optimal subsets from a given set. He extends the classic path-independence property from choice functions to choice correspondences, providing a new tool for allocating complex resources.

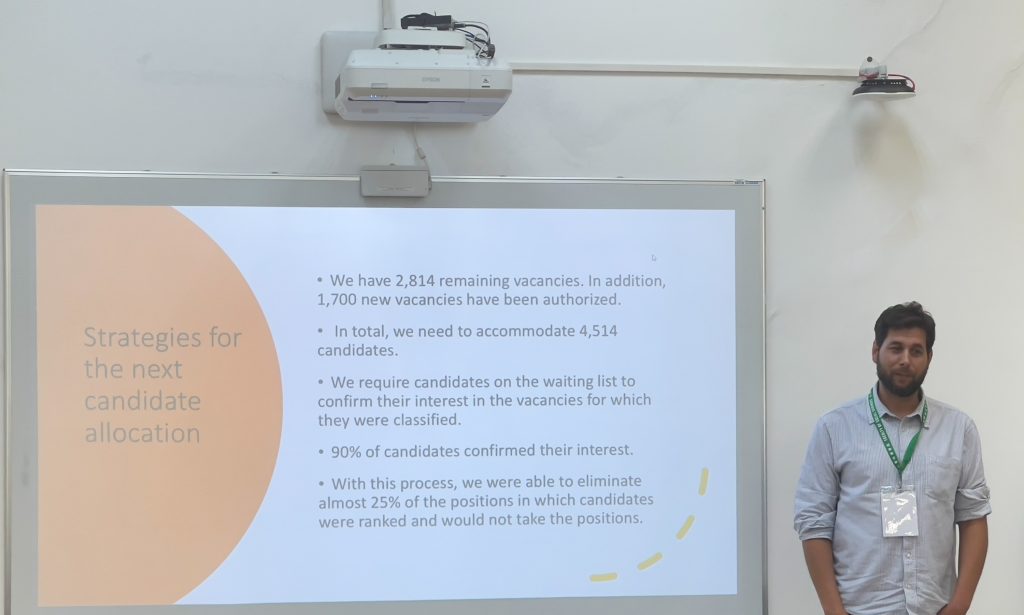

4. Screening for Stability: Designing the Brazilian Unified National Public Competition

Inácio Bó (University of Macau, Macao)

Prof. Inácio Bó studies the application of market design theory in real life. He participates in the design of the reform of the Unified National Public Competition in Brazil, reconstructing the selection and matching of the Brazil’s Unified National Public Competition by using market design theory. This work has served over two million candidates, achieving policy goals while enhancing the quality of selection and matching.

5. Unified National Civil Service Jobs Selection – A reflection between market design theory and its real application

Pedro Assumpção (Ministry of Public Service Management and Innovation, Brazil)

Prof. Pedro Assumpção analyzed Brazil’s Unified National civil servant exam from reflective perspectives. This exam, which integrated recruitment for multiple federal agencies for the first time, attracted over two million candidates. The studies pointed out that traditional methods often lead to inefficiencies and unfilled vacancies, while market design techniques such as phased matching, waitlist management, and quota implementation can significantly improve both match quality and policy fairness.

6. Identifying and Quantifying (Un)Improvable Students

Josue Ortega (Queen’s University Belfast, United Kingdom)

Prof. Josue Ortega focuses on inefficiencies in mechanism design for large markets. He finds that the Deferred Acceptance mechanism suffers from systematic inefficiency of striking magnitude that almost all students can improve their assignments without harming others. Using a new digraph framework, they characterize all the unimprovable students and establish a disjoint trading cycle in which nearly all students are improvable. This finding raises fundamental questions about the widely used Deferred Acceptance mechanism.

7. The Structure of Bayesian Stable Matchings

Gaoji Hu (Shanghai University of Finance and Economics, China)

Prof. Gaoji Hu studies the structure of stable matchings under incomplete information. He finds that classic results like the Lone Wolf and Lattice Theorems may fail in Bayesian settings, and a common information decomposition framework is introduced to rebuild the structural theory.

8. Priority-Based Incentives in Organ Donation

Mengling Li (Xiamen University, China)

Prof. Mengling Li examines the Organ Donation market. She examined priority-based incentives in organ donation, showing that granting priority to registered deceased donors can indirectly encourage living donation only if living donors also receive sufficiently high priority in allocation, which offer valuable guidance for designing effective policies to increase organ supply.

9. Fair Allocation with Beneficiary-Share Guarantee

Manshu Khanna (Peking University HSBC Business School, China)

Prof. Manshu Khanna focuses on balancing efficiency and fairness in market design. He proposed setting minimum beneficiary-share guarantees in resource allocation. He showed a characterization of the efficiency-equity frontier, which iteratively applied the Hungarian Algorithm to compute all optimal solutions efficiently. This is applicable to the allocation of scarce resources like vaccines and medical equipment.

10. Rank-Guaranteed Auctions

Jiangtao Li (Singapore Management University, Singapore)

Prof. Jiangtao Li focuses on the complex preferences common in real world markets. To overcome the disadvantage of traditional models, they design a new auction mechanism called Combinatorial Ascending Auction (CASA). This mechanism allows auctioneers to bid on any combination in the menu and make the payment only after ensuring that all combinations are satisfactory, which can ensures that the auctioneer earns at least what they would get by selling each bundle at its combination-menus-increases-by-one-th highest value.

11. On Competitive Equilibria and Cores in Housing Markets with One Broker

Yongchao Zhang(Shanghai University of Finance and Economics, China)

Prof. Yongchao Zhang explores the housing market with a broker, proving that even with an intermediary, a unique competitive equilibrium and strong core allocation exist, extending the classic housing market model.

12. An Axiomatization of the Random Priority Rule

Christian Basteck (WZB Berlin Social Science Center, Germany)

Prof. Christian Basteck focuses on random assignments. He proves that the Random Priority rule is the only assignment method satisfying three key properties: equal treatment of equals, efficiency, and probabilistic monotonicity. The latter requires assignments to become more likely as they move up in everyone’s preferences. The finding establishes why this commonly used rule is uniquely fair and responsive.

13. Marginal Mechanisms for Balanced Exchange

Vikram Manjunath (University of Ottawa, Canada)

Prof. Vikram Manjunath focuses on efficiency and fair outcome. He studied marginal mechanisms in object exchange that rely only on marginal preferences over individual items, showing that under certain conditions, individual rationality and Pareto efficiency can be simultaneously achieved, offering a new solution for bundle exchange.

14. What makes the difference: Deriving characterizations of DA and IA from basic properties

Di Feng (Dongbei University of Finance and Economics, China)

Prof. Di Feng focuses on the distinctions between the Deferred Acceptance (DA) and Immediate Acceptance (IA) mechanisms. By strengthening basic properties such as efficiency, fairness, and incentives, he offers clear guidance for mechanism selection in practice.

This workshop highlights the market design as a practical subject, how to rigorous algorithm and mechanism, to complex social problems provides a scientific, fair and efficient solution.

The scholar’s research, is moving towards the real world from academic papers, drive the impact millions of system innovation, also for the Greater Bay Area construction more efficient, more fair resource allocation system made important enlightenment.