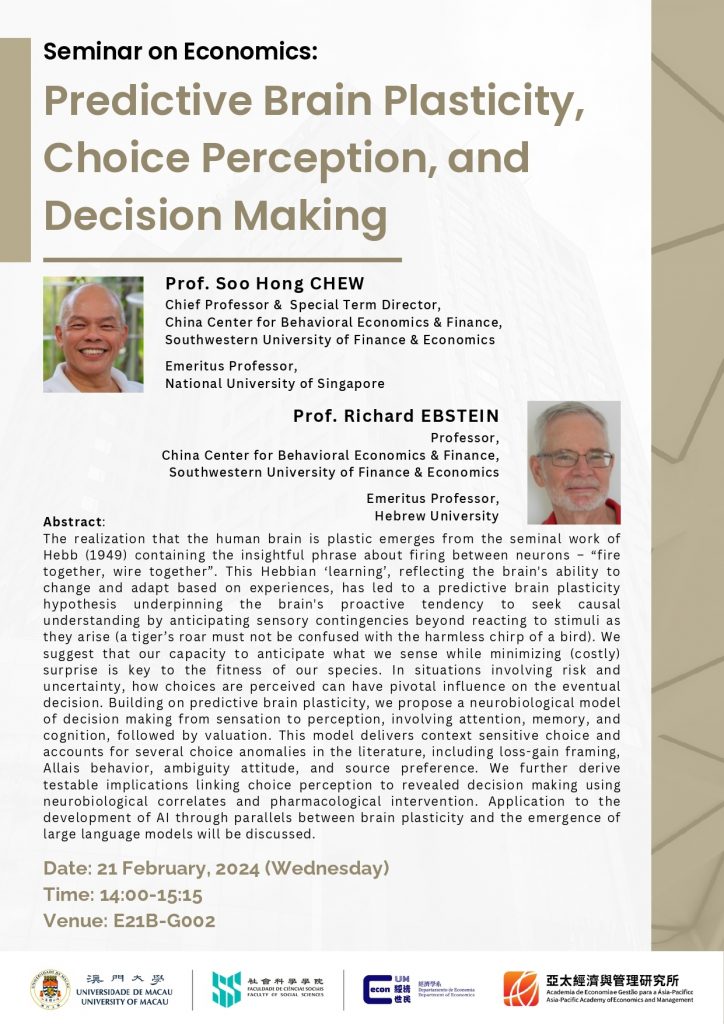

經濟學系研討會: Predictive Brain Plasticity, Choice Perception, and Decision Making

| Speaker: | 周恕弘教授 | Chief Professor & Special Term Director, China Center for Behavioral Economics & Finance, Southwestern University of Finance & Economics

Emeritus Professor, National University of Singapore |

| Richard EBSTEIN教授 | Professor, China Center for Behavioral Economics & Finance, Southwestern University of Finance & Economics

Emeritus Professor, Hebrew University |

日期:2024年2月21日 (星期三)

時間:14:00 – 15:15

地點: E21B-G002

內容: The realization that the human brain is plastic emerges from the seminal work of Hebb (1949) containing the insightful phrase about firing between neurons – “fire together, wire together”. This Hebbian ‘learning’, reflecting the brain’s ability to change and adapt based on experiences, has led to a predictive brain plasticity hypothesis underpinning the brain’s proactive tendency to seek causal understanding by anticipating sensory contingencies beyond reacting to stimuli as they arise (a tiger’s roar must not be confused with the harmless chirp of a bird). We suggest that our capacity to anticipate what we sense while minimizing (costly) surprise is key to the fitness of our species. In situations involving risk and uncertainty, how choices are perceived can have pivotal influence on the eventual decision. Building on predictive brain plasticity, we propose a neurobiological model of decision making from sensation to perception, involving attention, memory, and cognition, followed by valuation. This model delivers context sensitive choice and accounts for several choice anomalies in the literature, including loss-gain framing, Allais behavior, ambiguity attitude, and source preference. We further derive testable implications linking choice perception to revealed decision making using neurobiological correlates and pharmacological intervention. Application to the development of AI through parallels between brain plasticity and the emergence of large language models will be discussed.