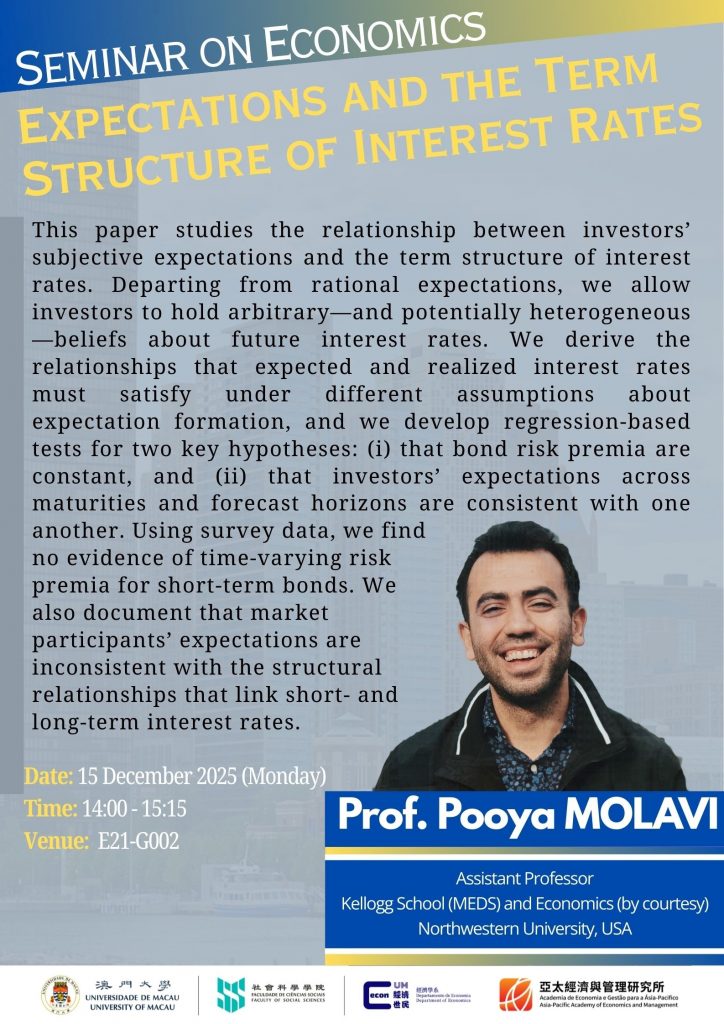

經濟學系講座: Expectations and the Term Structure of Interest Rates

講者: Pooya MOLAVI教授/美國西北大學凱洛格管理學院和經濟學系助理教授

日期:15/12/2025 (三)

時間: 14:00-15:15

語言: 英語

地點: E21B-G002

內容: This paper studies the relationship between investors’ subjective expectations and the term structure of interest rates. Departing from rational expectations, we allow investors to hold arbitrary—and potentially heterogeneous—beliefs about future interest rates. We derive the relationships that expected and realized interest rates must satisfy under different assumptions about expectation formation, and we develop regression-based tests for two key hypotheses: (i) that bond risk premia are constant, and (ii) that investors’ expectations across maturities and forecast horizons are consistent with one another. Using survey data, we find no evidence of time-varying risk premia for short-term bonds. We also document that market participants’ expectations are inconsistent with the structural relationships that link short- and long-term interest rates.